- The Asian Infrastructure Investment Bank (AIIB) is a new international development bank that provides financing for infrastructure projects in Asia.

- It began operations in January 2016.

- The AIIB is a multilateral development bank headquartered in Beijing.

- Like other development banks, its mission is to improve social and economic outcomes in its region, Asia, and beyond.

- China’s leader Xi Jinping first proposed an Asian infrastructure bank at an APEC summit in Bali in 2013.

- Many observers have interpreted the bank as a challenge to international lending bodies such as WB, IMF.

- The bank currently has 105 members, including 16 prospective members from around the world.

- The United Nations has addressed the launch of AIIB as having potential for “scaling up financing for sustainable development“ and to improve the global economic governance.

- The starting capital of the bank was US$100 billion, equivalent to 2⁄3 of the capital of the Asian Development Bank and about half that of the World Bank.

- India is the 2nd largest shareholder of AIIB. India is also the largest Borrower from AIIB.

- In 2018, AIIB was granted Permanent Observer status in the deliberations of both the United Nations General Assembly and the Economic and Social Council.

AIIB – Founding Members

Countries accepted as AIIB founding members include

- China, India, Malaysia, Indonesia, Singapore, Saudi Arabia, Brunei, Myanmar, the Philippines, Pakistan, Britain, Australia, Brazil, France, Germany and Spain.

Shareholders of AIIB

- China is the largest shareholder with 26.61 % voting shares in the bank, followed by India (7.6%), Russia (6.01%), and Germany (4.2 %)

AIIB & India

- India is the largest beneficiary of AIIB financing for infrastructure projects and is the second-largest shareholder (7.6%) in the bank only to China.

- The AIIB has approved more loans for India than any other bank member and has funded 28 projects in India, amounting to USD6.7 billion.

- India, in October 2021, India applied for loans from the AIIB and Asian Development Bank (ADB) under the ADB’s Asia Pacific Vaccine Access Facility (APVAX) initiative.

- The projects in India span a range of sectors such as energy, water, transport, etc.

- The bank has also approved $500 million for a COVID-19 Emergency Response Fund and Health Systems Preparedness Project.

- AIIB also approved a USD 356.67 million loan to the Indian government to support the expansion of the Chennai metro rail system.

New Development Bank

About NDB

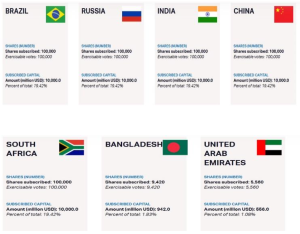

- The New Development Bank (NDB) BRICS group of nations comprising Brazil, Russia, India, China and South Africa .

- This was established in 2015.

- To begin with, the bank will start operating with $50 billion in initial capital with the five BRICS contributing $10 billion each.

- According to the pact, the capital of the bank will be divided equally among the five participating nations and initially it will focus on infrastructure projects member countries.

- The headquarters of the bank will be located in Shanghai, China.

- Eminent banker Kondapur Vamana Kamath was appointed as first President New Development Bank .NDB) of BRICS nations.

- Bangladesh & UAE became members of NDB in September & October 2021 respectively.

Founding Members

Additional Information

- The Bank shall mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies

- Unlike the World Bank, which assigns votes based on capital share, in the New Development Bank each participant country will be assigned one vote, and none of the countries will have veto power.

- The first regional office of the NDB is in Johannesburg, South Africa.

- The second regional office was established in 2019 in São Paulo, Brazil, followed by Moscow, Russia.

- Egypt & Uruguay are Prospective Members to NDB.

Capital Structure & Subscription

- NDB has the initial authorised capital of USD 100 billion, which is divided into one million shares that have a par value of one hundred thousand dollars each.

- NDB’s founding members made an initial subscription of five hundred thousand shares totalling USD 50 billion.

- Which include one hundred thousand shares corresponding to a paid-in capital of USD 10 billion.

- And four hundred thousand shares corresponding to a callable capital of USD 40 billion.

- The initial subscribed capital was equally distributed amongst the founding members.

NDB – Partnerships

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177