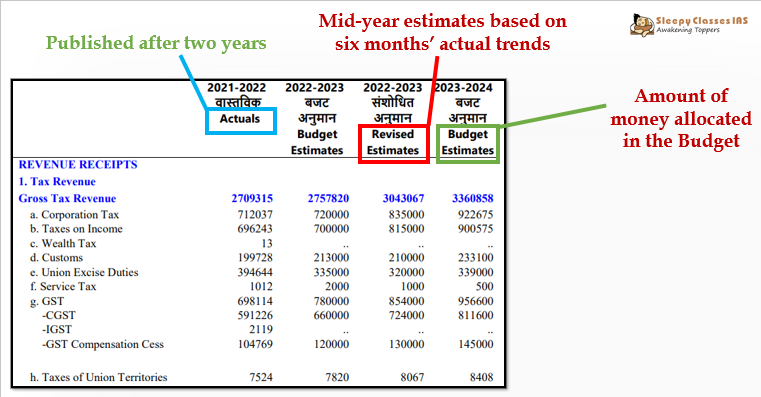

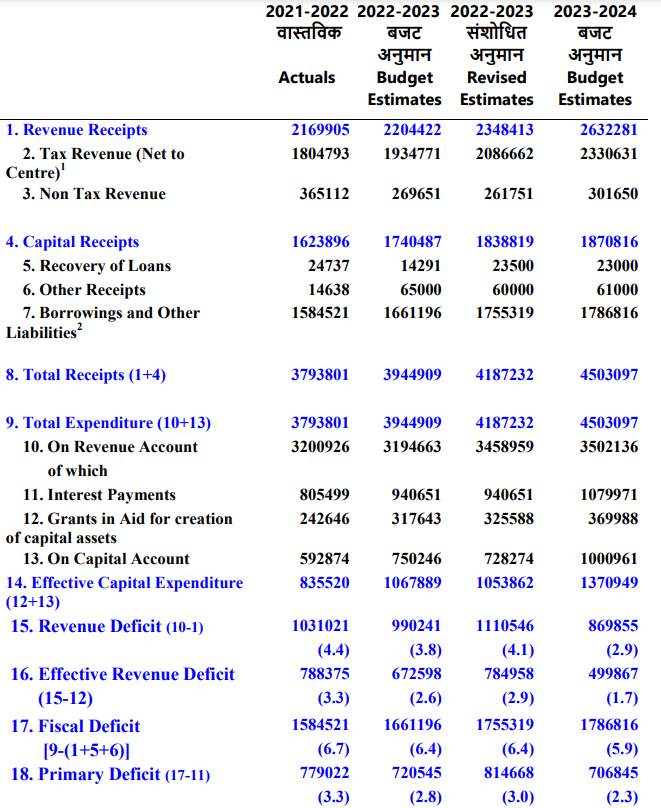

Annual Financial Statement

As per Article 112 of the Constitution, the government is required to present a statement of estimated receipts and expenditures in respect of every financial year (from April 1 to March 31), to the Parliament.

Financial Bill

- Finance Bill is a form of proposal the central government proposes to the Parliament for approval to introduce or amend taxes or the current tax structure (or continue with the same).

- It can only be presented in Lok Sabha.

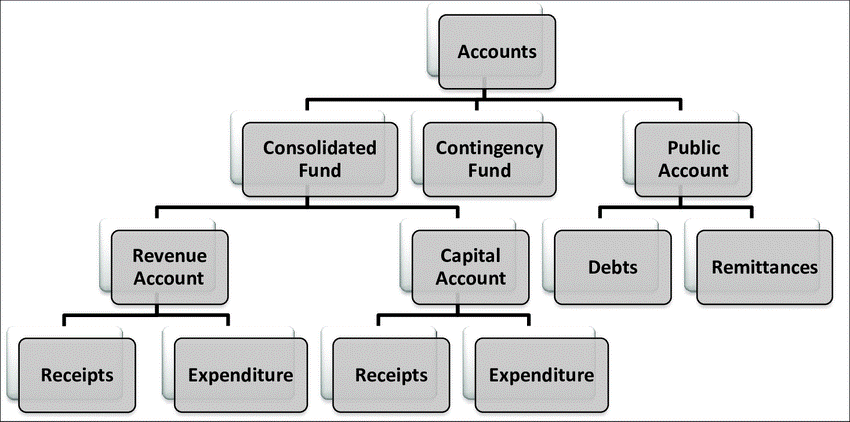

Consolidated Fund

- Consolidated Fund of India includes revenues received and expenses incurred by the government in a financial year, except exceptional expenses like disaster management.

- All government expenditure is made from this fund except exceptional expenditure.

Monetary Policy and Fiscal Policy

Capital Expenditure

- Capital expenditure or CapEx refers to the total spending on the purchase of assets in a given period.

Direct and Indirect Tax

- Indirect taxes are charged on goods and services, while direct taxes are charged on profits and income.

Types of Deficit

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177