Questions from Crash Course

1. Which of the following statements is/are correct?

- Gross National Product of a nation includes the income earned by a resident from his/her foreign asset.

- Gross National Income of a nation includes the income earned by foreigners located in the country.

A. 1 Only

B. 2 Only

C. Both are Correct

D. None is Correct

2. An economic finding that income ratios between high and low income countries are systematically exaggerated by GDP conversion at market exchange rates is known as:

A. GDP Deflator

B. Purchasing Power Parities

C. Penn Effect

D. Price Level Indexes

Questions from Test Series

Foundation Test – 4 (Economy)

3. Consider the following statements with reference to the types of goods in an economy?

- An inferior good has a negative income elasticity of demand.

- Tea and Coffee are Substitute Goods.

- Giffen Goods are rare goods in which a price increase leads to an increase in demand.

Which of the statements given above is/are correct?

A. 2 only

B. 2 and 3 only

C. 1 only

D. 1, 2 and 3

4. Consider the following pairs:

| Term | Meaning |

| G-sec | Tradeable instrument issued by RBI having a debt obligation |

| Treasury Bills (T-bills) | Debt instruments which are issued for less than 365 days and are redeemed at face value |

| Inflation Indexed

Bonds |

Bonds wherein both coupon flows and Principal amounts are protected against inflation |

| Recapitalization

Bonds |

Bonds re-issued by government to change the price of face value of bond |

Which of the pairs given above is/are correctly matched?

A. 1 and 4 only

B. 2 and 3 only

C. 1 and 2 only

D. 3 and 4 only

UPSC Previous Year Question 2020

5. In the context of the Indian economy, non-financial debt includes which of the following?

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

A. 1 only

B. 1 and 2 only

C. 3 only

D. 1, 2 and 3

Answers with Explanations

Questions from Crash Course

1. Which of the following statements is/are correct?

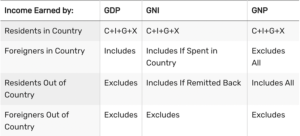

- Gross National Product of a nation includes the income earned by a resident from his/her foreign asset.

- Gross National Income of a nation includes the income earned by foreigners located in the country.

A. 1 Only

B. 2 Only

C. Both are Correct

D. None is Correct

Answer: A

Explanation

2. An economic finding that income ratios between high and low income countries are systematically exaggerated by GDP conversion at market exchange rates is known as:

A. GDP Deflator

B. Purchasing Power Parities

C. Penn Effect

D. Price Level Indexes

Answer: C

Explanation

- Market exchange rate–converted GDP — that is, nominal GDP converted to a common currency using market exchange rates—can be highly misleading with regard to the relative size of economies.

- Price levels are normally higher in high-income economies than they are in low-income economies; as a result, differences in price levels between high-income economies and low-income economies are greater for non-traded items than they are for traded items.

- Before the addition of tariffs, subsidies, and trade costs, the prices of traded items are basically determined globally by the law of one price, whereas the prices of non-traded items are determined by local circumstances, in particular, by wages and salaries, which are generally higher in high-income economies.

- If the larger differences in price level for non-traded items are not taken into account when converting GDP to a common currency, the size of high-income economies with high price levels will be overstated and the size of low-income economies with low price levels will be understated.

- This is known as the Penn effect.

Questions from Test Series

Foundation Test – 4 (Economy)

3. Consider the following statements with reference to the types of goods in an economy?

- An inferior good has a negative income elasticity of demand.

- Tea and Coffee are Substitute Goods.

- Giffen Goods are rare goods in which a price increase leads to an increase in demand.

Which of the statements given above is/are correct?

A. 2 only

B. 2 and 3 only

C. 1 only

D. 1, 2 and 3

Answer: D

Explanation

- Goods are items and resources that meet people’s needs and desires. A good can be a physical item, a service, or a combination of the two. Almost anything is good if it provides some sort of benefit to consumers.

- Since goods are diverse, they’re categorized into distinct groups with unique characteristics that determine their value.

Inferior Goods

- Statement 1 is correct

- An inferior good is one in which an increase in income causes a decrease in demand. It has a negative elasticity of demand. For example, as your income grows, you buy less low-value bread and more high-quality, organic bread.

Substitute Goods

- Statement 2 is correct

- Substitute goods or competing goods are those which can be used in place of a commodity. Tea and coffee are substitute goods. If there is a rise in the prices of tea, the demand for coffee will increase. Products that are alternatives, such as Pepsi and Coca-Cola.

Giffen Good

Statement 3 is correct

- A rare type of good in which a price increase leads to an increase in demand. Since you can’t afford more expensive goods, the income effect of a price increase causes you to buy more of this cheap good. For example, if the price of wheat rises, a poor peasant may no longer be able to afford other alternatives, so they are compelled to purchase more wheat.

4. Consider the following pairs:

| Term | Meaning |

| G-sec | Tradeable instrument issued by RBI having a debt obligation |

| Treasury Bills (T-bills) | Debt instruments which are issued for less than 365 days and are redeemed at face value |

| Inflation Indexed

Bonds |

Bonds wherein both coupon flows and Principal amounts are protected against inflation |

| Recapitalization

Bonds |

Bonds re-issued by government to change the price of face value of bond |

Which of the pairs given above is/are correctly matched?

A. 1 and 4 only

B. 2 and 3 only

C. 1 and 2 only

D. 3 and 4 only

Answer: B

Explanation

Pair 1 is incorrect

- Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation.

- Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

Pair 2 is correct

- T-bills are money market short term debt instruments which are issued by the central government in three tenures mainly 91-day, 182-day and 364-day. These instruments are zero coupon bonds which pay no interest but are actually issued at a discount and redeemed at the face value at maturity

Pair 3 is correct

- Inflation Indexed Bonds (IIBs) are bonds wherein both coupon flows and Principal amounts are protected against inflation. The inflation index used in IIBs may be Whole Sale Price Index (WPI) or Consumer Price Index (CPI).

Pair 4 is incorrect

- Government is the majority shareholder in the public sector banks. Therefore, it must provide equity capital if the banks are struggling. This injection of capital is also known as the recapitalisation of banks.

- Recapitalisation bonds can be issued either directly by the government or through a holding company.

- The annual interest on these bonds and the principal on redemption will be paid by the central government. These bonds can be sold off by the banks in the market when in need of capital.

UPSC Previous Year Question 2020

5. In the context of the Indian economy, non-financial debt includes which of the following?

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

A. 1 only

B. 1 and 2 only

C. 3 only

D. 1, 2 and 3

Answer: D

Explanation

Non Financial Debt

The debt held by governments, households, and companies not in the financial sector.

All the options are correct.

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177