1. Which one of the following statements correctly describes “Reverse Currency War”?

- Policy of official currency devaluation aimed at improving each nation’s foreign trade competitiveness at the expense of other nations.

- A situation where Central Banks deliberately pursues policies to strengthen the values of their currencies.

- When a country will incur losses due to adverse exchange rate movements by entering into and settling a transaction in a foreign currency.

- None of the above

2. Which of the following is/are correct India Innovation Index ?

- It is released by NITI Aayog and Institute for Competitiveness.

- Indicators like ‘Knowledge diffusion’ and ‘Governance’ are used while computing the index.

- India’s GERD per capita lower than China but higher than South Africa.

Select the correct answer using the code given below:

- 1 only

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3 only

3. Consider the following statements with respect to Digital Lending Rules followed in India.

- Lending Service Providers (LSPs) are the entities which are regulated by the RBI and are allowed to carry out lending business.

- Under first loss default guarantee agreements, fintech promises to compensate the partners up to a pre-decided percentage in case customers fail to repay the loans.

Which of the above statements is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- None of the above

4. Which one of the following statements is incorrect with respect to Central Bank Digital Currency?

- Digital Rupee is considered as a legal tender in India.

- Wholesale CBDC is restricted for access to select financial institutions only.

- In a token-based CBDC, the person receiving a token will verify that his ownership of the token is genuine.

- None of the above

5. Consider the following statements, with reference to the AT-1 Bonds:

- These bonds are perpetual in nature.

- SEBI had ruled that AT1 bonds should be sold only in minimum ticket sizes of ₹1 crore and above, to institutional investors.

Which of the statements given above is/are correct?

- 1 Only

- 2 Only

- Both 1 and 2

- Neither 1 nor 2

Answers with Explanations

1. Which one of the following statements correctly describes “Reverse Currency War”?

- Policy of official currency devaluation aimed at improving each nation’s foreign trade competitiveness at the expense of other nations.

- A situation where Central Banks deliberately pursues policies to strengthen the values of their currencies.

- When a country will incur losses due to adverse exchange rate movements by entering into and settling a transaction in a foreign currency.

- None of the above

Answer: 2

Explanation

Reverse Currency War

What happens during Currency War?

- In the past the US has often accused other countries of manipulating their currency (and keeping its weaker against the dollar) just to enjoy a trade surplus against the US.

- Weakness of country’s local currency against the dollar makes their exports more competitive.

Click here for A Few Minutes Series Video.

2. Which of the following is/are correct India Innovation Index ?

- It is released by NITI Aayog and Institute for Competitiveness.

- Indicators like ‘Knowledge diffusion’ and ‘Governance’ are used while computing the index.

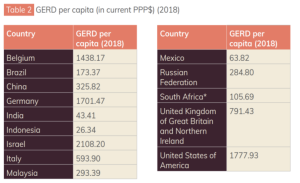

- India’s GERD per capita lower than China but higher than South Africa.

Select the correct answer using the code given below:

- 1 only

- 1 and 2 only

- 2 and 3 only

- 1, 2 and 3 only

Answer: 1

Explanation

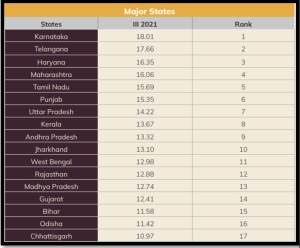

India Innovation Index 2021

- Prepared by NITI Aayog and the Institute for Competitiveness, the India Innovation Index is a comprehensive tool for the evaluation and development of the country’s innovation ecosystem.

- It ranks the states and the union territories on their innovation performance to build healthy competition amongst them.

Click here for A Few Minutes Series Video

3. Consider the following statements with respect to Digital Lending Rules followed in India.

- Lending Service Providers (LSPs) are the entities which are regulated by the RBI and are allowed to carry out lending business.

- Under first loss default guarantee agreements, fintech promises to compensate the partners up to a pre-decided percentage in case customers fail to repay the loans.

Which of the above statements is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- None of the above

Answer: 2

Explanation

- Reserve Bank of India (RBI) issued the ‘Guidelines on Digital Lending’ to banks and non- banking financial companies (NBFCs), which disburse loans through digital lending platforms.

- Lending Service Providers (LSPs) operate in collaboration with Non-Banking Financial Companies (NBFCs) who disburse credit to customers using the former’s platform.

- All loan disbursals and repayments are to be executed between the bank accounts of the borrower and the entity. This eliminates the presence of a nodal pass-through or pool account of the LSP.

- Lenders must inform the borrower about all the fees, charges, and the annual percentage rate (APR) in a standardised format.

Click here for A Few Minutes Series Video.

4. Which one of the following statements is incorrect with respect to Central Bank Digital Currency?

- Digital Rupee is considered as a legal tender in India.

- Wholesale CBDC is restricted for access to select financial institutions only.

- In a token-based CBDC, the person receiving a token will verify that his ownership of the token is genuine.

- None of the above

Answer: 4

Explanation

Type of CBDC to be issued

(CBDC-R)

- Potentially available for use by all

- Electronic version of cash primarily meant for retail transactions.

- It can provide access to safe money for payment and settlement as it is a direct liability of the Central Bank.

(CBDC-W)

- Restricted access to select financial institutions

- Intended for the settlement of interbank transfers and related wholesale transactions

- Potential to transform the settlement systems for financial transactions and make them more efficient and secure.

Forms of CBDC

- CBDC can be structured as ‘token-based’ or ‘account-based’.

- A token-based CBDC is a bearer-instrument like banknotes, meaning whosoever holds the tokens at a given point in time would be presumed to own them.

- In a token-based CBDC, the person receiving a token will verify that his ownership of the token is genuine

- An account-based system would require maintenance of record of balances and transactions of all holders of the CBDC and indicate the ownership of the monetary balances.

- In an account-based CBDC, an intermediary verifies the identity of an account holder.

Click here for A Few Minutes Series Video.

5. Consider the following statements, with reference to the AT-1 Bonds:

- These bonds are perpetual in nature.

- SEBI had ruled that AT1 bonds should be sold only in minimum ticket sizes of ₹1 crore and above, to institutional investors.

Which of the statements given above is/are correct?

- 1 Only

- 2 Only

- Both 1 and 2

- Neither 1 nor 2

Answer: 3

Explanation

AT 1 Bonds

- To shore up their Tier 1 capital, banks were allowed to raise a special class of bonds known as AT1 bonds from investors.

- AT1 bonds, like other bonds, pay regular interest. But they do not have a maturity date, as they are a permanent part of the bank’s capital, akin to equity.

- In practice, however, banks do offer a call option on these bonds after five years, when they may or may not redeem them.

- If the RBI believes that the bank is becoming short of capital or unviable to operate, it can direct the principal on these bonds to be written off too.

Click here for A Few Minutes Series Video.

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC: https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177