1. Consider the following statements with respect to Municipal Bonds.

- These bonds is only available to institutional investors due to default risk associated with it.

- General Obligation Bonds are issued for a specific purpose such as construction of a toll road or a toll bridge.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. None of the above.

2. Which of the following are allowed to issue Certificate of Deposit?

- Scheduled Commercial Banks

- Regional Rural Banks

- Small Finance Banks

- Cooperative Banks

Select the correct code:

A. 1, 2 and 3 only

B. 2, 3 and 4 only

C. 1, 3 and 4 only

D. 1 and 3 only

3. With reference to the National Single Window System, consider the following statements:

- It was launched in 2021 by the Ministry of Corporate Affairs.

- It is a digital platform for guidance of investors to identify and to apply for approvals as per their business requirements.

- The portal is yet to host applications for approval from State Governments.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 2 and 3 only

4. Which one of the following statement is incorrect?

A. A revenue deficit shows a shortage of funds with the government to maintain its day-to-day affairs.

B. A shrinking primary deficit points to the recovering fiscal health of an economy.

C. Primary deficit is arrived at by deducting interest payments on previous borrowings from the current year’s fiscal deficit.

D. None of the above.

5. A Market System that has only one buyer for a particular good or service, giving that buyer significant power in determining the price of the products produced is

A. Oligopoly

B. Monopsony

C. Monopoly

D. Monopolistic Competition

Answers with Explanation

1. Consider the following statements with respect to Municipal Bonds.

- These bonds is only available to institutional investors due to default risk associated with it.

- General Obligation Bonds are issued for a specific purpose such as construction of a toll road or a toll bridge.

Which of the statements given above is/are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. None of the above.

Answer: D

Explanation

- Municipal bonds are fixed income instruments, i.e. debt securities issued by the Government or semi-Government institutions who need funding for civic projects.

- There are two types of municipal bonds – General Obligation Bonds and Revenue Bonds.

- General Obligation Bonds are issued for enhancing civic amenities such as water, sanitation, garbage disposal, etc.

- Revenue Bonds are issued for a specific purpose such as construction of a toll road or a toll bridge.

Municipal bonds have been in the market since 1997.

- Bangalore Municipal Corporation is the first urban local body to issue municipal bonds in India.

- The Ahmedabad Municipal Corporation, in 1998, was the first to make a public offering.

- Indore recently became the first city to list municipal bonds on the National Stock Exchange (NSE) in 2018.

- SEBI circulated detailed guidelines for Urban Local Bodies (ULBs) in 2015 to raise funds by issuing municipal bonds.

Eligibility for issue:

- The municipality must not have a negative net worth in each of the three previous years.

- The issuer (municipal corporations) should get the bonds rated by credit rating agencies.

- There should be no default in any kind of loan in the past one year and it must maintain full collateral/asset cover to repay the principal amount.

- For revenue bond, the revenue generated from the project should be kept in a separate escrow account and financial institutions would monitor their accounts regularly.

2. Which of the following are allowed to issue Certificate of Deposit?

- Scheduled Commercial Banks

- Regional Rural Banks

- Small Finance Banks

- Cooperative Banks

Select the correct code:

A. 1, 2 and 3 only

B. 2, 3 and 4 only

C. 1, 3 and 4 only

D. 1 and 3 only

Answer: A

Explanation

Reserve Bank of India (Certificate of Deposit) Directions, 2021

- Certificate of Deposits (CDs) may be issued by:

- Scheduled Commercial Banks;

- Regional Rural Banks; and

- Small Finance Banks.

- CDs shall be issued only in dematerialised form and held with a depository registered with Securities and Exchange Board of India.

- CDs shall be issued in minimum denomination of ₹5 lakh and in multiples of ₹5 lakh thereafter.

- The tenor of a CD at issuance shall not be less than seven days and shall not exceed one year.

- Banks are not allowed to grant loans against CDs, unless specifically permitted by the Reserve Bank.

3. With reference to the National Single Window System, consider the following statements:

- It was launched in 2021 by the Ministry of Corporate Affairs.

- It is a digital platform for guidance of investors to identify and to apply for approvals as per their business requirements.

- The portal is yet to host applications for approval from State Governments.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 2 and 3 only

Answer: B

Explanation

- The National Single Window System (NSWS) is a digital platform for guidance of investors to identify and to apply for approvals as per their business requirements.

- The platform is built to serve as an advisory tool to identify approvals based on user input and is to be used for guidance purpose only.

- The platform was soft launched in September 2021 by the Ministry of Commerce & Industry.

- The portal hosts applications for approvals from 26 Central Departments and 19 State Governments. These approvals can be applied through NSWS.

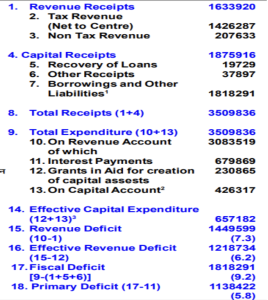

- Which one of the following statement is incorrect?

A. A revenue deficit shows a shortage of funds with the government to maintain its day-to-day affairs.

B. A shrinking primary deficit points to the recovering fiscal health of an economy.

C. Primary deficit is arrived at by deducting interest payments on previous borrowings from the current year’s fiscal deficit.

D. None of the above.

Answer: D

Explanation

- A revenue deficit shows a shortage of funds with the government to maintain its day-to-day affairs. When total revenue expenditure exceeds total revenue receipts it leads to a revenue deficit.

- The Centre often resorts to borrowings and divestments to make up for this gap in revenue, alongside the introduction of new or increasing taxes.

- Meanwhile, the fiscal deficit is the negative balance that arises whenever the govt spends more money than it receives.

- A primary deficit shows the government’s borrowings to meet interest payments. Therefore, a shrinking primary deficit points to the recovering fiscal health of an economy. Primary deficit is arrived at by deducting interest payments on previous borrowings from the current year’s fiscal deficit.

5. A Market System that has only one buyer for a particular good or service, giving that buyer significant power in determining the price of the products produced is

A. Oligopoly

B. Monopsony

C. Monopoly

D. Monopolistic Competition

Answer: B

Explanation

- A monopsony is a market condition in which there is only one buyer, the monopsonist.

- Like a monopoly, a monopsony also has imperfect market conditions.

- The difference between a monopoly and monopsony is primarily in the difference between the controlling entities.

- A single buyer dominates a monopsonized market while an individual seller controls a monopolized market.

- Monopsonists are common to areas where they supply most or all of the region’s jobs.

- In a monopsony, a large buyer controls the market.

- Because of their unique position, monopsonies have a wealth of power.

- For example, being the primary or only supplier of jobs in an area, the monopsony has the power to set wages.

- In addition, they have bargaining power as they are able to negotiate prices and terms with their suppliers.

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177