1. Which one of the following statements correctly describes “Revenue Neutral Rate”?

- A mechanism and supervisory arrangement to monitor and increase the tax coverage.

- It is a neutral which will be used to identify, classify and define services under the GST.

- A rate of tax that allows the Government to receive the same amount of money despite changes in the tax laws.

- None of the above

2. Which one of the following statements is correct with respect to Apparel Export Promotion Council (AEPC)?

- It functions under the Ministry of Commerce and Industry.

- Its chairman is appointed by the Prime Minister on the recommendations of the apparel industry to the Government.

- It provides assistance to Indian exporters as well as importers/international buyers who choose India as their preferred sourcing destination for garments.

- None of the above

3. Arrange the following in the increasing order of their contribution in deficit financing in India.

- Market Borrowings

- External Debt

- State Provident Funds

- Securities against Small Savings

Select the correct code:

- 2-3-1-4

- 3-2-4-1

- 2-3-4-1

- 3-2-1-4

4. Which one of the following statements is/are correct with respect to Online Bond Platform Providers?

- Their operations are outside Sebi’s regulatory purview.

- OBBP are fintech companies or are backed by stock brokers.

- They offer debt securities to non-institutional investors.

Select the correct code:

- 1 and 2 only

- 2 and 3 only

- 2 only

- 1 and 3 only

5. In the context of the participatory notes in the Indian economy, consider the following statements:

- Participatory note is a derivative instrument issued in foreign jurisdictions.

- This instrument was introduced to curb the menace of black money.

- They are regulated by the RBI.

Which of the statements given above is/are correct?

- 1 only

- 1 and 3 only

- 2 only

- 2 and 3 only

Answers with Explanation

1. Which one of the following statements correctly describes “Revenue Neutral Rate”?

- A mechanism and supervisory arrangement to monitor and increase the tax coverage.

- It is a neutral which will be used to identify, classify and define services under the GST.

- A rate of tax that allows the Government to receive the same amount of money despite changes in the tax laws.

- None of the above

Answer: 3

Source: Crash Course 2023

Explanation

Revenue Neutral Rate

- The focus under GST is to arrive at such rates which would not decrease the current revenue generation of the central and State Governments.

- Revenue Neutral Rate (RNR) is a structure of different rates established to match the current revenue generation with the revenue under GST.

- RNR calculation must include the cascading effect on certain goods having no excise or sales tax implications.

- For example – Wheat would get costlier due to the RNR fixed for diesel being higher than the current tax rate even though wheat does not have any excise or sales tax implications.

2. Which one of the following statements is correct with respect to Apparel Export Promotion Council (AEPC)?

- It functions under the Ministry of Commerce and Industry.

- Its chairman is appointed by the Prime Minister on the recommendations of the apparel industry to the Government.

- It provides assistance to Indian exporters as well as importers/international buyers who choose India as their preferred sourcing destination for garments.

- None of the above

Answer: 3

Source: Pre Test Series 2023

Explanation

Apparel Export Promotion Council (AEPC)

- APEC was incorporated in 1978.

- It is an official body of apparel exporters in India that provides assistance to Indian exporters as well as importers/international buyers who choose India as their preferred sourcing destination for garments.

- It functions under the Ministry of Textiles.

- AEPC is today a powerful body for the promotion and facilitation of garment manufacturing and their exports.

- For Indian exporters, AEPC is quite literally a one-stop shop for information advise technical guidance workforce and market intelligence.

- The Chairman of the Council is elected by the executive committee of the Council. The executive committee includes persons from the both the Government and the Industry.

- AEPC is registered Companies’ Act 1956 and has two categories of Members: Member Exporter and Registered Exporter.

- Any applicant, firm or society and/or Statutory Organization who is an exporter of garments whether manufacturer exporter or merchant exporter in the export and aims and objective of the council shall be eligible to be registered as a Registered Exporter of the Council.

3. Arrange the following in the increasing order of their contribution in deficit financing in India.

- Market Borrowings

- External Debt

- State Provident Funds

- Securities against Small Savings

Select the correct code:

- 2-3-1-4

- 3-2-4-1

- 2-3-4-1

- 3-2-1-4

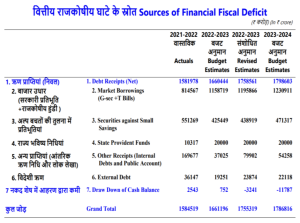

Answer: 2

Source: Crash Course 2023

Explanation

4. Which one of the following statements is/are correct with respect to Online Bond Platform Providers?

- Their operations are outside Sebi’s regulatory purview.

- OBBP are fintech companies or are backed by stock brokers.

- They offer debt securities to non-institutional investors.

Select the correct code:

- 1 and 2 only

- 2 and 3 only

- 2 only

- 1 and 3 only

Answer: 2

Source: Current Affairs 2023

Explanation

- Online Bond Platform: As per SEBI, Online Bond Platform is an electronic system other than a recognised stock exchange or an electronic book providing platform, on which debt securities are listed or proposed to be listed are offered and transacted.

- Online Bond Platform Providers (OBPPs) are companies incorporated in India.

- They offer government securities, high-quality corporate bonds, instruments with AA and lower ratings, market-linked debentures, and even perpetual bonds.

- As per the framework, obtaining registration as a stock broker in the debt segment of a stock exchange, an entity would have to apply to SEBI to act as an OBPP.

- In its application, the entity will have to provide the detailed of roles and obligations, technology, operating framework, Know Your Client (KYC) documents etc.

- The entity would have to ensure compliance with the minimum disclosure requirements.

5. In the context of the participatory notes in the Indian economy, consider the following statements:

- Participatory note is a derivative instrument issued in foreign jurisdictions.

- This instrument was introduced to curb the menace of black money.

- They are regulated by the RBI.

Which of the statements given above is/are correct?

- 1 only

- 1 and 3 only

- 2 only

- 2 and 3 only

Answer: 1

Source: Crash Course (Quiz) 2023

Explanation

- A Participatory Note (PN or P-Note) in the Indian context, in essence, is a derivative instrument issued in foreign jurisdictions, by a SEBI registered FII, against Indian securities the Indian security instrument may be equity, debt, derivatives or may even be an index.

- PNs are also known as Overseas Derivative Instruments, Equity Linked Notes, Capped Return Notes, and Participating Return Notes.

- It is considered a highly ‘safe and lucrative route’ to invest the ‘unaccounted’, ‘even illegal’ money into the Indian security market for huge profits (during the booming period).

- Experts even imagined that it may be allowing the ‘black money’ of India (stashed away from India through ‘hawala’ kind of illegal channels and deposited in the tax havens of the world in ‘Swiss Bank’ kind of financial institutions) to get invested back in the market.

- PNs are market instruments that are created and traded overseas. Hence, Indian regulators cannot ban the issue of PNs.

- However, they can be regulated, as SEBI does when a PN is traded on an overseas exchange, the regulator in that jurisdiction would be the authority to regulate that trade.

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC: https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177