The Bombay High Court last week set aside the order by the administrator of YES Bank which directed that the Additional Tier-1 (AT-1) bonds of the bank worth ₹8,300 crore be written-off as part of its reconstruction.

Bank Capital

- After the global financial crisis of 2007-08, it was felt that banks ought to operate with a higher proportion of their own, permanent capital as opposed to borrowed capital.

- Regulatory Capital

- Tier 1 Capital

-

- Common Equity Tier 1

-

- Additional Tier 1

- Tier 2 Capital

Tier 1 and Tier 2 Capital

- Capital is divided into tiers according to the characteristics/qualities of each qualifying instrument.

- For supervisory purposes capital is split into two categories: Tier I and Tier II.

- Tier I capital consists mainly of share capital and disclosed reserves and it is a bank’s highest quality capital because it is fully available to cover losses.

- Tier II capital, on the other hand, consists of certain reserves and certain types of subordinated debt. The loss absorption capacity of Tier II capital is lower than that of Tier I capital.

AT 1 Bonds

- To shore up their Tier 1 capital, banks were allowed to raise a special class of bonds known as AT1 bonds from investors.

- AT1 bonds, like other bonds, pay regular interest. But they do not have a maturity date, as they are a permanent part of the bank’s capital, akin to equity.

- In practice, however, banks do offer a call option on these bonds after five years, when they may or may not redeem them.

- If the RBI believes that the bank is becoming short of capital or unviable to operate, it can direct the principal on these bonds to be written off too.

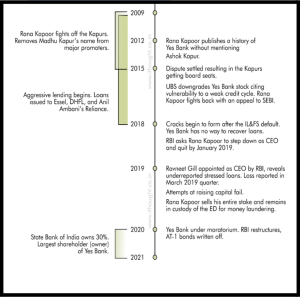

YES Bank AT1 Issue

- Yes Bank officials were guilty of mis-selling these bonds to unsuitable investors such as senior citizens, with institutional investors offloading their bonds to retail clients.

New SEBI Guideline

- As the RBI and banks enjoy complete discretion to skip interest payouts, defer the call option or write-off the principal on AT1 bonds, they are wholly unsuitable for retail investors.

- SEBI had ruled that AT1 bonds should be sold only in minimum ticket sizes of ₹1 crore and above, to institutional investors.

- But older tranches of AT1 bonds continue to trade at lower lot sizes of ₹10 lakh in the market. They are offered to individual investors by brokers, as ‘high yield’ FD substitutes.

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177