Question 1

Geography | Cyclones | Easy | The Hindu

SOURCE

Consider the following pairs: (Cyclones and names in the region)

Willy Willy – Atlantic Ocean

Hurricane – Australia

Typhoon – Pacific Ocean

How many pairs is or are correct?

A. Only one

B. Only two

C. All three

D. None of the above

Solution & Detailed Explanation

Answer: (A) Only one

Detailed Explanation

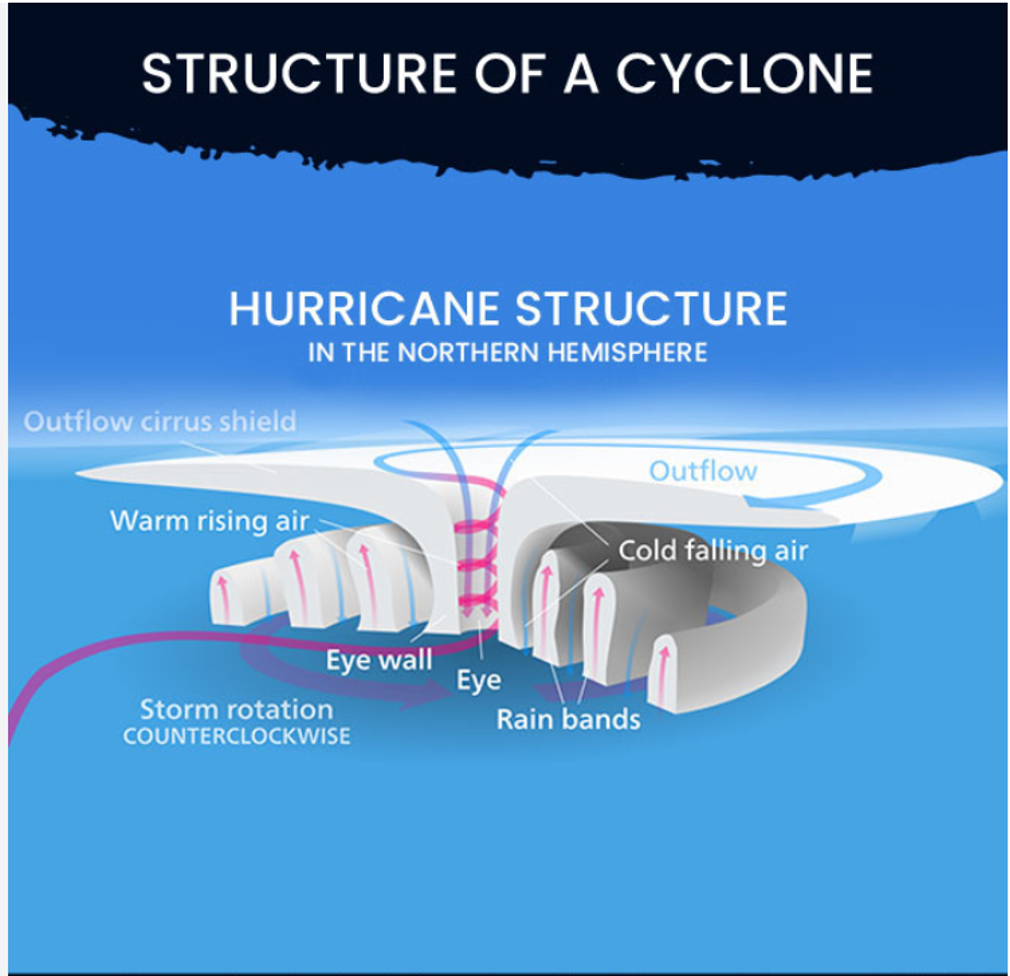

- A cyclone is known by different names around the world based on its geographical location: it’s called a hurricane in the Atlantic Ocean, a typhoon in the Western Pacific Ocean (including the China Sea), and a tropical cyclone in the Indian Ocean and South Pacific. The term willy-willy is sometimes used in North-western Australia to refer to these storm.

- Cyclones form over warm ocean waters where rising warm, moist air creates a low-pressure system. As surrounding air rushes in to fill the low-pressure zone, it warms, rises, and cools to form clouds, fuelling a continuous, rotating cycle. This system spins due to the Earth’s rotation (the Coriolis force), developing into an eye at its calm centre and powerful winds in the eyewall as it grows stronger.

Question 2

Economy | GST | Medium | The Hindu

SOURCE

Consider the following:

1. The Goods and Services Tax Appellate Tribunal (GSTAT) has been constituted under section 109 of the CGST Act 2017.

2. The Goods and Services Tax Appellate Tribunal (GSTAT) is a statutory appellate body.

Which of the statements above is or are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. None of the above

Solution & Detailed Explanation

Answer: (C) Both 1 and 2

Detailed Explanation

- The Goods and Services Tax Appellate Tribunal (GSTAT) is a statutory appellate body established under the Goods and Services Tax laws. It has been constituted to hear appeals against orders passed by the GST Appellate Authorities and to provide taxpayers with an independent forum for justice. The Tribunal will function through a Principal Bench in New Delhi and 31 State Benches across 45 locations in India, thereby ensuring accessibility and nationwide reach.

- Each Bench of the GSTAT will comprise two Judicial Members, one Technical Member (Centre), and one Technical Member (State), ensuring a balanced composition of judicial expertise and technical knowledge from both Central and State administrations. This structure reflects the spirit of cooperative federalism and is designed to deliver impartial and consistent decisions.

- The Goods and Services Tax Appellate Tribunal (GSTAT) has been constituted under section 109 of the Central Goods and Services Tax (CGST) Act, 2017.

- It is a statutory body established to hear appeals against orders passed by the first Appellate Authorities or the Revisional Authorities under the GST laws.

- Key aspects of the GSTAT:

- Purpose: The GSTAT is the second level of appeal for resolving GST-related disputes between taxpayers and the tax authorities. Its establishment aims to streamline tax litigation and reduce the burden on High Courts.

- Structure: The tribunal has a tiered structure to ensure nationwide access to justice.

- Principal Bench: The Principal Bench is located in New Delhi. It consists of a President, one Judicial Member, one Technical Member (Centre), and one Technical Member (State).

- State Benches: In addition to the Principal Bench, the government constitutes State Benches at various locations as requested by states.

- Composition: Each bench includes a mix of judicial and technical members to provide a balanced approach to the resolution of tax disputes. The specific composition and quorum for different types of cases are also defined under the Act.

- Jurisdiction: The Principal Bench handles appeals involving “place of supply” issues, while State Benches handle all other matters. The government may also notify other specific cases to be heard only by the Principal Bench.

- Operational status: The establishment of the GSTAT was a much-anticipated move for taxpayers. While the provision for the tribunal existed from 2017, its full operationalization was delayed. Following the appointment of members and the notification of procedure rules, the Principal Bench was officially launched on September 24, 2025, and is expected to hear cases starting in December 2025.

Question 3

Governance | Schemes | Medium | The Hindu

SOURCE

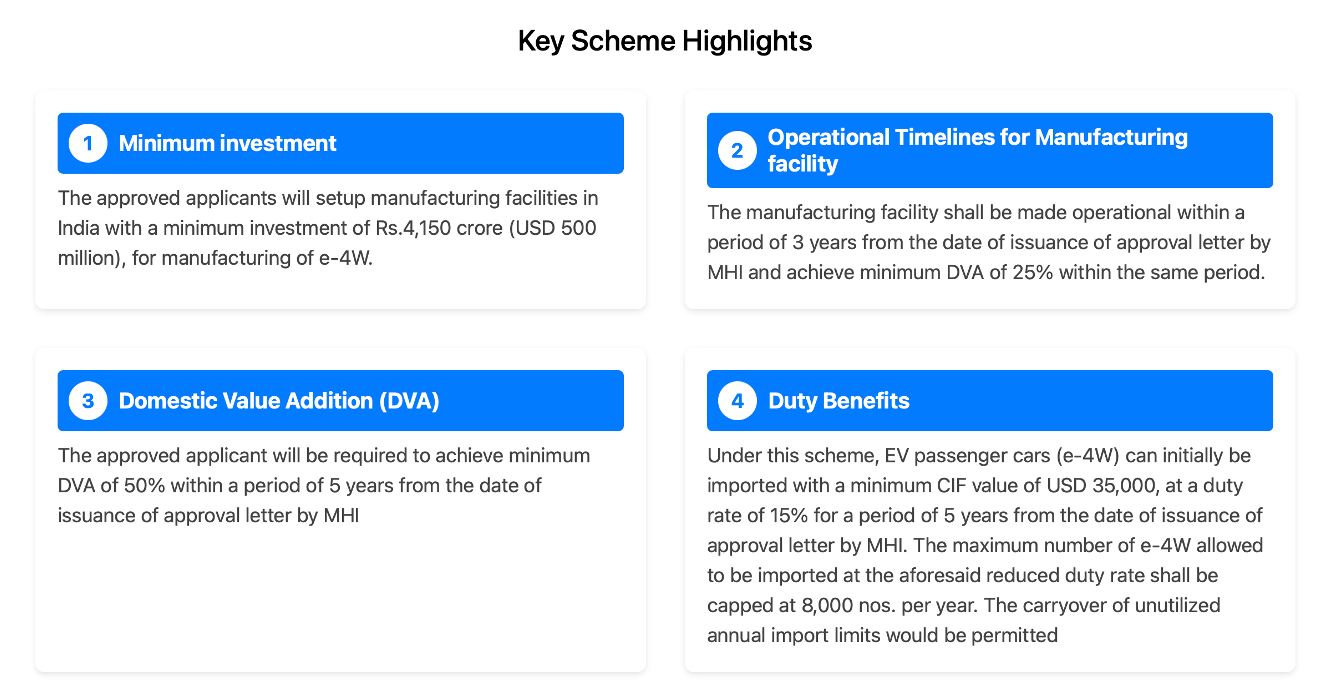

Which of the following is incorrect about Scheme to Promote Manufacturing of Electric Passengers Cars in India (SPMEPCI):

A. The approved applicants will setup manufacturing facilities in India with a minimum investment of Rs.4,150 crore.

B. The manufacturing facility shall be made operational within a period of 1 year from the date of issuance of approval.

C. The approved applicant will be required to achieve minimum DVA of 50% within a period of 5 years.

D. The maximum number of e-4W allowed to be imported are capped at 8,000 nos. per year.

Solution & Detailed Explanation

Answer: (B) The manufacturing facility shall be made operational within a period of 1 year from the date of issuance of approval.

Detailed Explanation

Question 4

Governance | Schemes | Medium | The Hindu

SOURCE

Consider the following:

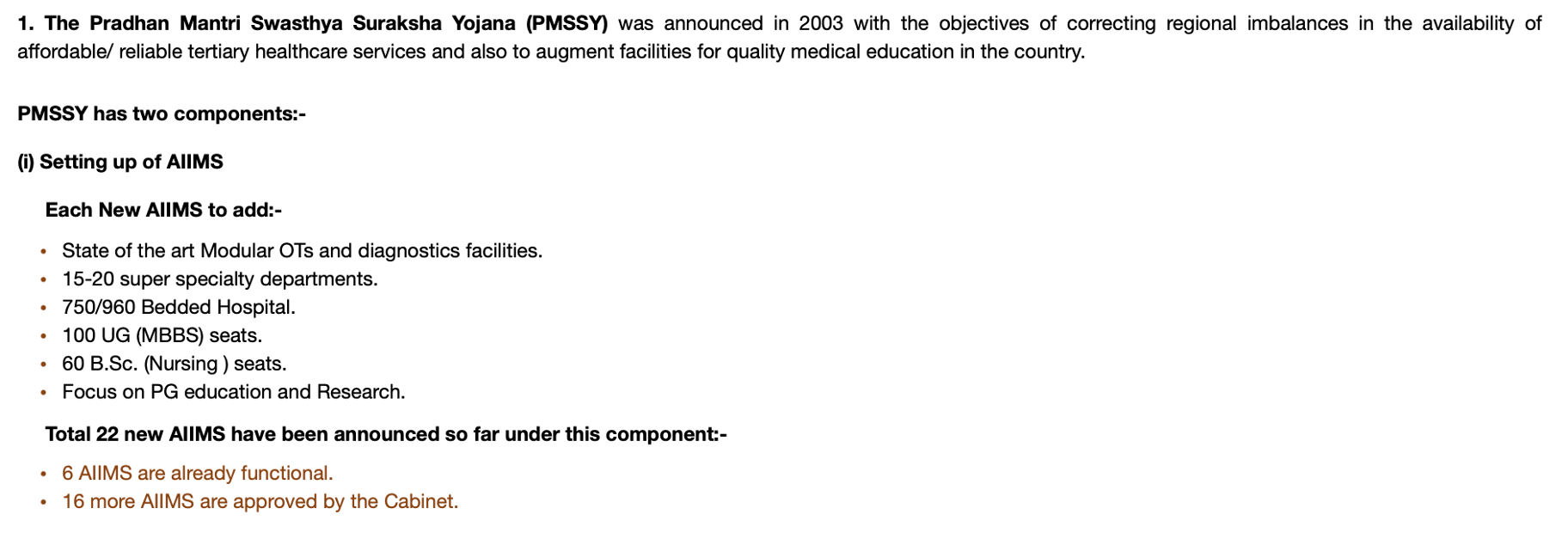

1. Pradhan Mantri Swasthya Suraksha Yojana was launched in 2013.

2. Objectives of Pradhan Mantri Swasthya Suraksha Yojana were to correct regional imbalances.

Which of the statements above is or are correct?

A. 1 only

B. 2 only

C. Both 1 and 2

D. None of the above

Solution & Detailed Explanation

Answer: (B) 2 only

Detailed Explanation

Question 5

Economy | Banking | Medium | The Hindu

SOURCE

Arrange the following conditions from most to least liquid form:

1. Currency+ Demand Deposit + Savings deposits with Post Office savings banks.

2. Currency + Demand Deposit + Net time deposits of commercial banks.+ Total deposits with Post Office savings organizations.

3. Currency + Demand Deposit.

4. Currency + Demand Deposit + Net time deposits of commercial banks.

Choose the correct answer from the options given below:

A. (1), (2), (3), (4)

B. (3), (1), (4), (2)

C. (2), (1), (4), (3)

D. (3), (2), (4), (1)

Solution & Detailed Explanation

Answer: (B) (3), (1), (4), (2)

Detailed Explanation

- Money supply, like money demand, is a stock variable. The total stock of money in circulation among the public at a particular point of time is called money supply. RBI publishes figures for four alternative measures of money supply, viz. M1, M2, M3 and M4. They are defined as follows:

- M1 = CU + DD

- M2 = M1 + Savings deposits with Post Office savings banks

- M3 = M1 + Net time deposits of commercial banks

- M4 = M3 + Total deposits with Post Office savings organisations (excluding National Savings Certificates)

- where, CU is currency (notes plus coins) held by the public and DD is net demand deposits held by commercial banks. The word ‘net’ implies that only deposits of the public held by the banks are to be included in money supply. The interbank deposits, which a commercial bank holds in other commercial banks, are not to be regarded as part of money supply.

- M1 and M2 are known as narrow money. M3 and M4 are known as broad money. These measures are in decreasing order of liquidity.

- M1 is most liquid and easiest for transactions whereas M4 is least liquid of all. M3 is the most commonly used measure of money supply. It is also known as aggregate monetary resources.