Central Bank Digital Currencies (CBDCs) are like the new kids on the block in the financial world, and they’re really shaking things up. Imagine a digital form of money issued by central banks that’s as easy to use as your favorite payment app. It’s a big deal because it could change how we handle money, pay for stuff, and even how governments manage economies. With the UPSC 2025 exams coming up, understanding these digital currencies isn’t just for tech geeks anymore; it’s essential for anyone looking to ace those tests. Let’s break down why these digital currencies are being called the future of finance.

Key Takeaways

- CBDCs are digital versions of traditional money issued by central banks, aiming to simplify transactions.

- They could drastically change how traditional banks operate, impacting everything from loans to savings.

- These currencies promise to make financial services more accessible, especially for people without bank accounts.

- Security and privacy are major concerns, but they also offer a chance to improve how we protect financial data.

- CBDCs are becoming a hot topic in global finance, and they’re especially relevant for UPSC 2025 aspirants.

Understanding Central Bank Digital Currencies

Definition and Key Features

Central Bank Digital Currencies (CBDCs) are digital versions of a country’s official currency, issued and regulated by the central bank. Unlike cryptocurrencies, which are decentralized and often volatile, CBDCs are designed to offer stability and security. They are backed by the full faith and credit of the issuing government. Essentially, CBDCs function like physical cash but exist in a digital format, making them accessible through digital wallets and other electronic means. The aim is to combine the convenience of digital transactions with the trust and stability associated with traditional fiat currencies.

Historical Context and Evolution

The concept of digital currencies isn’t entirely new. It finds its roots in the rise of cryptocurrencies like Bitcoin, which introduced the idea of a decentralized digital currency. However, CBDCs differ significantly as they are centralized and regulated by government authorities. Over the years, many countries have explored the idea of CBDCs, seeing them as a way to modernize payment systems and reduce reliance on cash. The Bahamas was the first to launch a nationwide CBDC, the Sand Dollar, in 2020, setting a precedent for other nations.

Global Adoption Trends

Globally, the interest in CBDCs has surged. Countries like China, with its Digital Yuan, and the European Union, with its Digital Euro, are leading the charge in implementing these digital currencies. Other nations, including Nigeria with its eNaira and Russia with its Digital Ruble, are also in various stages of development or pilot testing. The push towards CBDCs is driven by the potential benefits they offer, such as enhanced payment efficiency, reduced transaction costs, and improved monetary policy implementation. However, the journey to widespread adoption is complex, involving regulatory challenges and technological hurdles.

The Role of Central Bank Digital Currencies in Modern Finance

Impact on Traditional Banking Systems

Central Bank Digital Currencies (CBDCs) are shaking up traditional banking systems. Banks, which have long been the gatekeepers of financial transactions, are facing a new reality. With CBDCs, individuals can hold digital currency directly with the central bank, reducing dependency on private banks for basic transactions. This could lead to a decrease in the demand for bank deposits, impacting their revenue from interest spreads. Banks might have to innovate and offer new services to stay competitive in this evolving landscape.

Integration with Existing Financial Infrastructure

Integrating CBDCs with current financial systems is no small feat. It requires a seamless connection between digital currencies and existing payment networks. Central banks are working on ensuring that CBDCs can be used alongside traditional money without causing disruptions. This integration involves upgrading infrastructure to handle digital transactions efficiently and securely. For instance, digital wallets and mobile payment systems must be compatible with CBDCs to facilitate widespread adoption.

Potential for Financial Inclusion

One of the most exciting prospects of CBDCs is their potential to boost financial inclusion. In many parts of the world, people lack access to traditional banking services. CBDCs can provide a way for these individuals to participate in the economy by offering a secure and accessible form of digital money. With the use of mobile technology, even those in remote areas can manage their finances and make transactions. This could lead to a more inclusive financial system where everyone has the opportunity to participate and benefit from economic activities.

The introduction of CBDCs could redefine how we interact with money, making financial systems more inclusive, efficient, and secure. It’s a step towards a future where everyone has equal access to financial resources, potentially transforming economies worldwide.

By enhancing financial systems, CBDCs are poised to play a significant role in adapting to the evolving digital financial landscape. Their impact on traditional banking, integration challenges, and promise of financial inclusion highlight the transformative potential of digital currencies in modern finance.

Technological Framework Behind Central Bank Digital Currencies

Blockchain and Distributed Ledger Technology

Central Bank Digital Currencies (CBDCs) are often built on blockchain technology, which provides a secure and transparent way to handle transactions. Unlike traditional databases, blockchain is decentralized, meaning no single entity has control over the entire network. This decentralization ensures that data is less prone to tampering and fraud. Distributed Ledger Technology (DLT) underpins this system, allowing multiple participants to have synchronized access to a constantly updated ledger. This is crucial for maintaining trust and integrity in digital transactions. However, the choice between a permissioned or permissionless blockchain can significantly impact the design and operation of a CBDC.

Security and Privacy Considerations

Security is a top priority when it comes to implementing CBDCs. Advanced encryption methods are used to protect data from unauthorized access. Ensuring the privacy of users is equally important, as digital currencies can potentially expose sensitive transaction information. Balancing transparency with privacy is a challenge that developers face. Implementing robust identity verification processes without compromising user anonymity is a delicate task. Additionally, real-time monitoring systems are essential to detect and prevent fraudulent activities.

Scalability and Efficiency Challenges

Scalability is a significant concern for CBDCs, especially as they need to handle a large number of transactions simultaneously. The system must be efficient enough to process these transactions quickly without delays. This requires a robust infrastructure that can support high transaction throughput. Solutions like sharding, where the database is split into smaller, more manageable pieces, are being explored to enhance scalability. However, achieving this without compromising security remains a complex issue.

The technological backbone of CBDCs is a delicate balance of innovation and practicality, aiming to revolutionize how we perceive and use money in the digital age. As nations explore this frontier, the focus remains on creating a system that is secure, efficient, and inclusive.

Economic Implications of Central Bank Digital Currencies

Influence on Monetary Policy

Central Bank Digital Currencies (CBDCs) could shake up how monetary policy is done. By allowing central banks more direct control over money supply, they could make it easier to implement policy changes quickly. Imagine a world where interest rates can be adjusted almost in real-time! But, there’s a catch. This could mean traditional banking systems might face challenges in maintaining their roles in the economy. For a deeper dive into these dynamics, check out the comprehensive overview.

Effects on Inflation and Interest Rates

The introduction of CBDCs might play a role in controlling inflation and interest rates. Since these digital currencies can provide more precise data on money circulation, central banks could better predict inflation trends and adjust interest rates accordingly. However, this new level of control could also lead to unforeseen challenges, especially if not managed carefully. Central banks must ensure that these tools are used judiciously to avoid destabilizing the economy.

Role in Economic Stability

CBDCs have the potential to enhance economic stability by reducing the reliance on physical cash, which can be costly to produce and manage. A digital currency system could lead to lower transaction costs and improved efficiency in monetary transactions. Yet, there’s a need to balance these benefits with the risks of centralization and the impact on commercial banks’ balance sheets. For insights into managing these risks, explore the established frameworks.

The shift towards digital currencies isn’t just about technology; it’s about reshaping the economic landscape. As central banks navigate this new terrain, the implications for economic stability and policy are profound. The journey is complex, but the potential rewards could be significant.

Central Bank Digital Currencies and Regulatory Challenges

Legal and Compliance Issues

Central Bank Digital Currencies (CBDCs) bring a whole new set of legal and compliance challenges. One of the most significant issues is how to integrate CBDCs into existing financial laws. Most financial regulations were crafted with traditional currencies in mind, so they don’t quite fit digital currencies. This means countries may have to rewrite parts of their financial laws to accommodate CBDCs. For example, the legal considerations for jurisdictions issuing retail CBDCs highlight the need for new legal frameworks. Additionally, there’s the challenge of ensuring that CBDCs comply with anti-money laundering (AML) and counter-terrorism financing (CTF) laws. These laws are crucial for maintaining the integrity of financial systems, but they need to be updated to address the unique characteristics of digital currencies.

Cross-Border Regulatory Coordination

Dealing with CBDCs across borders is another headache. Every country has its own set of rules, and when digital currencies cross borders, things can get messy. There’s no standard framework for how CBDCs should work internationally, which complicates things like trade and finance. For instance, the m-CBDC Bridge Project operates on a different framework than the digital euro or digital rupee. This lack of standardization makes it tough to facilitate smooth transactions between countries. To address these challenges, countries need to work together to develop a coordinated approach to CBDC regulation.

Consumer Protection and Privacy Laws

When it comes to CBDCs, consumer protection and privacy are big concerns. People want to know that their digital money is safe and that their personal information is protected. But CBDCs could potentially give central banks access to a lot of personal data, raising privacy concerns. This is why updating consumer protection and privacy laws is so important. These laws need to ensure that consumers are protected from fraud and data breaches while also maintaining their privacy. It’s a delicate balance that regulators need to strike to gain public trust in digital currencies.

As CBDCs continue to evolve, countries will need to navigate these regulatory challenges carefully. It’s not just about creating a digital currency; it’s about ensuring that it fits seamlessly into the existing financial landscape while protecting consumers and maintaining financial stability.

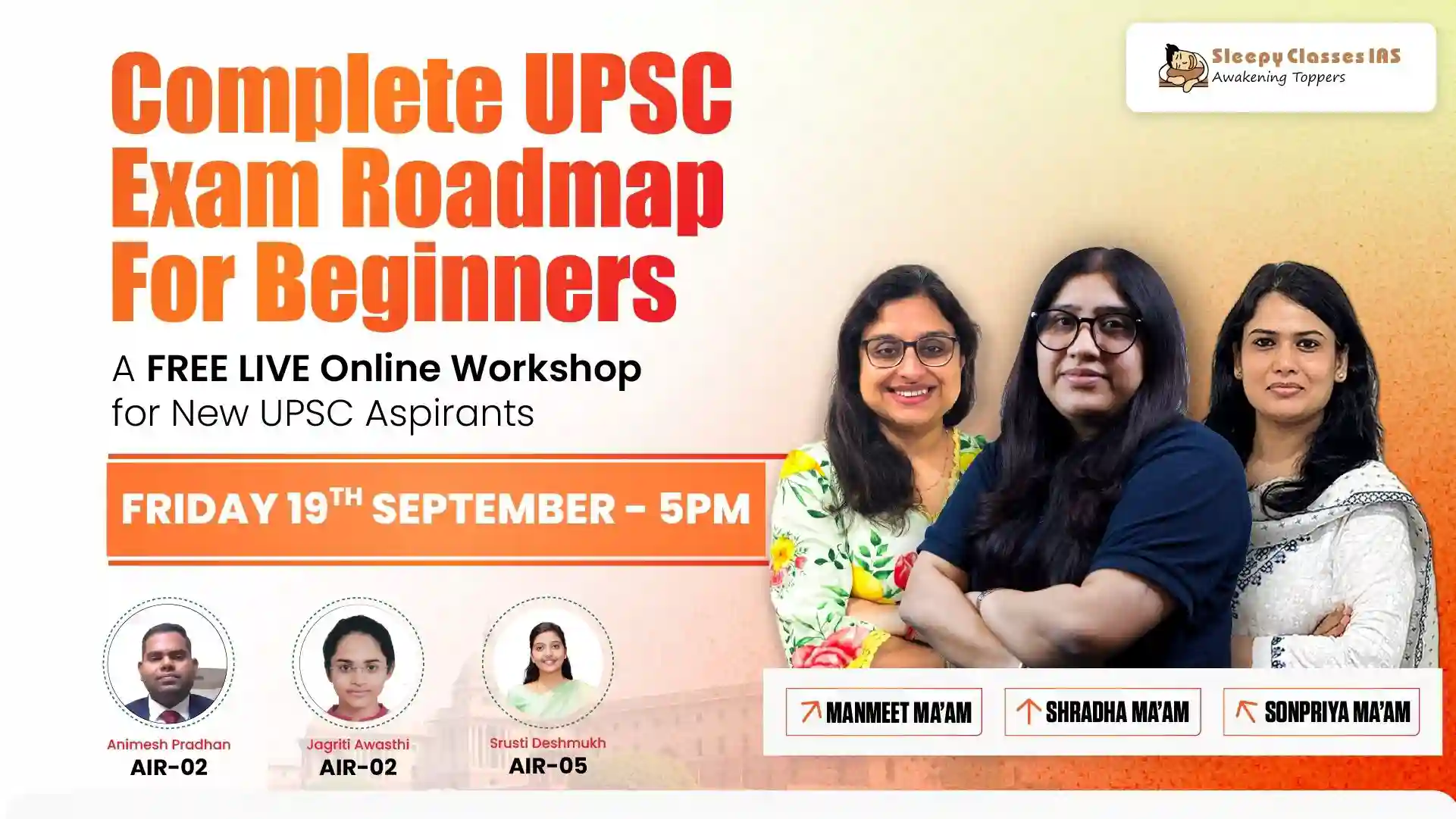

Central Bank Digital Currencies in the Context of UPSC 2025

Relevance to UPSC Syllabus

Central Bank Digital Currencies (CBDCs) are becoming a hot topic in the realm of economics and public policy. For those preparing for the UPSC 2025, understanding this concept is crucial. CBDCs are not just a part of the economic syllabus but also intersect with technology and governance. They touch on aspects of financial inclusion, monetary policy, and the digital economy—all key areas in the General Studies papers.

Potential Examination Questions

Aspirants might encounter questions like:

- Discuss the potential impact of CBDCs on India’s financial system.

- How do CBDCs align with the goals of financial inclusion?

- Analyze the challenges of implementing a CBDC in a developing economy like India.

These questions test not only knowledge but the ability to critically analyze and connect different aspects of the syllabus.

Preparation Strategies for Aspirants

- Stay Updated: Regularly follow current affairs related to CBDCs. This includes understanding global trends and India’s position.

- Understand the Basics: Grasp the fundamental concepts of digital currencies, including their benefits and challenges.

- Practice Writing: Develop the skill to write concise and analytical answers. This can be done by practicing with past papers and model questions.

- Join Discussions: Engage in study groups or online forums to discuss and debate the implications of CBDCs on various sectors.

Preparing for the UPSC exam is like running a marathon. It’s about consistent effort, staying informed, and honing your analytical skills. CBDCs might seem like a complex topic now, but with the right approach, it can become an area of strength in your preparation.

Case Studies of Central Bank Digital Currencies Worldwide

China’s Digital Yuan Initiative

China has been at the forefront of adopting Central Bank Digital Currencies (CBDCs) with its Digital Yuan, also known as e-CNY. The People’s Bank of China started pilot testing this digital currency back in 2020. It’s a significant move, considering China’s influence in global trade and economy. The Digital Yuan aims to replace some of the cash in circulation, facilitate easier transactions, and increase the government’s control over the financial system. Some key features include:

- Digital wallets for storing and transacting the currency.

- Integration with popular payment platforms like WeChat and Alipay.

- Aimed at reducing the cost and inefficiencies of cash handling.

European Central Bank’s Digital Euro

The European Central Bank (ECB) is exploring the potential of a Digital Euro. This initiative is part of a broader strategy to ensure that European citizens have access to a safe form of digital money. The Digital Euro is intended to complement cash, not replace it. The ECB’s approach involves:

- Conducting extensive research and consultations to understand public needs.

- Ensuring privacy and security are paramount in its design.

- Testing integration with existing financial systems to maintain stability.

Lessons from Emerging Economies

Emerging economies are also experimenting with CBDCs, with varying degrees of progress and success. For instance:

- Nigeria’s eNaira: Launched in 2021, it aims to improve financial inclusion and reduce transaction costs.

- Bahamas’ Sand Dollar: One of the first fully operational CBDCs, it focuses on enhancing financial access across the archipelago.

- Jamaica’s Jam-Dex: Currently in the pilot phase, targeting increased efficiency in the financial sector.

As nations continue to explore and implement CBDCs, they must balance innovation with regulation to ensure stability and security. This dynamic is especially relevant for UPSC aspirants who need to connect theory with practice, using effective examples to enhance their answers.

Future Prospects of Central Bank Digital Currencies

Predictions for Global Financial Systems

Central Bank Digital Currencies (CBDCs) are on the brink of transforming global finance. As more countries explore digital currencies, the financial landscape could shift dramatically. CBDCs promise to streamline cross-border transactions, making them faster and cheaper. This could lead to a more interconnected global economy, reducing reliance on traditional banking systems. In the future, CBDCs might even become the norm for international trade, replacing current systems that are often slow and costly.

Innovations in Payment Solutions

CBDCs could revolutionize how we handle money daily. Imagine paying for groceries with a quick scan of your phone, no cash or cards needed. This is the kind of innovation CBDCs can bring. They can support real-time payments and reduce transaction fees, benefiting both consumers and businesses. Moreover, CBDCs can integrate with existing digital platforms, enhancing the overall efficiency of payment systems.

Long-Term Economic Benefits

The long-term economic benefits of CBDCs are substantial. By reducing the need for physical cash, countries can save on printing and distribution costs. Additionally, CBDCs offer a more secure and traceable form of currency, reducing the risk of fraud and money laundering. Over time, this could lead to a more stable economic environment, with improved financial inclusion for those currently underserved by traditional banking. Ultimately, CBDCs could play a crucial role in fostering sustainable economic growth worldwide.

As we look to the future, the potential of CBDCs to reshape our financial systems is immense. They hold the promise of making financial transactions more efficient and accessible, paving the way for a new era in global finance. The journey towards widespread adoption is just beginning, and the possibilities are endless.

Challenges and Risks Associated with Central Bank Digital Currencies

Cybersecurity Threats

Central Bank Digital Currencies (CBDCs) are like a magnet for cybercriminals. As these digital forms of money become more common, they attract hackers, fraudsters, and all sorts of online thieves. The risk of cyberattacks on digital financial systems is a major concern. Just look at India’s history of cyberattacks on banks to get an idea of the potential threats. With more cybercrimes happening, like data breaches and identity theft, it’s clear that CBDCs need top-notch security.

Impact on Financial Privacy

Using CBDCs means the central bank might know a lot about your spending habits. This is different from cash, where transactions are private. The central bank could end up handling loads of data about what you buy and where. This raises big questions about privacy, especially if your transaction data gets compromised.

Risks of Centralized Control

With CBDCs, there’s a worry about too much power being centralized. If everyone starts using digital currency, it might reduce the role of commercial banks. This could lead to a situation where central banks have too much control over the financial system. Such centralization might make the system less flexible and more prone to systemic risks.

The shift to digital currencies is not just about technology; it’s about reshaping the entire financial landscape, and with that comes the responsibility to manage new risks and challenges.

High Implementation and Maintenance Costs

Setting up and keeping a CBDC running isn’t cheap. It takes a lot of money and technical know-how. For countries with tight budgets, this can be a real problem. Take the eNaira in Nigeria, for example. It cost a lot to get it off the ground, putting a strain on the central bank’s finances.

Limited Technological Readiness

Not every country is ready for CBDCs. Some places just don’t have the tech infrastructure needed. In India, for instance, about 45% of the population still lacks internet access. Plus, only around 25% are digitally literate, which makes rolling out CBDCs a tough task.

Cross-Border Regulatory Coordination

CBDCs aren’t just a local issue; they have international implications. Different countries have different rules, and this can make things tricky. Without a standard framework, international trade and transactions can get complicated. This is a big hurdle for CBDCs to overcome if they want to be part of the global financial system.

Central Bank Digital Currencies and the Future of Global Trade

Facilitating Cross-Border Transactions

Central Bank Digital Currencies (CBDCs) are stepping into the spotlight as potential game-changers for international trade. These digital currencies are designed to make cross-border transactions faster and more efficient. Imagine sending money to another country with the same ease as sending an email. That’s the promise of CBDCs. They can cut down the time it takes for international payments to clear, which is a big deal for businesses that rely on quick transactions to keep their operations running smoothly.

Reducing Transaction Costs

One of the standout benefits of CBDCs is the potential to slash transaction costs. Right now, moving money across borders can be expensive, with fees from banks and third-party services adding up quickly. CBDCs could change that by removing some of these intermediaries, leading to lower costs for businesses and consumers alike. This reduction in transaction fees can make a huge difference, especially for small businesses that operate on tight margins.

Enhancing Trade Efficiency

With the integration of CBDCs, trade efficiency could see a significant boost. By streamlining payment processes and reducing the need for currency exchange, CBDCs can help businesses manage their cash flows better. This is particularly important in today’s fast-paced global market where timing is everything. Companies could potentially see improvements in their supply chain management, leading to quicker turnaround times and more reliable delivery schedules.

In a world where time and cost are critical, CBDCs offer a promising solution to some of the biggest challenges in global trade. By making transactions quicker and cheaper, they have the potential to transform how businesses operate across borders.

Public Perception and Acceptance of Central Bank Digital Currencies

Public Awareness and Education

Central Bank Digital Currencies (CBDCs) are still a mystery to many. People are just starting to hear about them, and there’s a lot of confusion. Educating the public is key to making CBDCs work. Schools, governments, and financial institutions need to team up to spread the word. Workshops and online courses can help people understand what CBDCs are and how they work. It’s not just about awareness; it’s about making people comfortable with the idea of digital money.

Trust in Digital Financial Systems

Trust is a big deal when it comes to money. People want to know that their digital currency is safe and backed by something solid. Unlike cryptocurrency assets, which can be volatile, CBDCs are designed to be stable. They are backed by central banks, which gives them a level of trust. But still, people worry about hacking and data breaches. Building trust means showing that CBDCs are secure and that there are measures in place to protect users from cyber threats.

Addressing Public Concerns

People have questions about CBDCs. What happens if my digital wallet gets hacked? Will the government track my spending? These are real worries that need answers. Governments and banks must be transparent about how CBDCs will work and what safeguards are in place. Addressing these concerns head-on can help ease public anxiety and make people more willing to give digital currencies a try.

As CBDCs become more common, the challenge will be to balance innovation with security, ensuring that people feel confident using digital currencies in their everyday lives.

Central Bank Digital Currencies: A Tool for Financial Inclusion

Reaching the Unbanked Populations

Central Bank Digital Currencies (CBDCs) are stepping up as a game-changer in the financial world, especially for those who are unbanked. You know how not everyone has access to a bank, right? Well, CBDCs can really help with that. CBDCs have the potential to bring banking services to those who have been left out of the traditional banking system. With just a mobile phone, people can access digital wallets, making it easier for them to store and transfer money without needing a physical bank.

Here’s how CBDCs can reach the unbanked:

- Mobile Accessibility: Most people have mobile phones, even in remote areas. CBDCs can turn these devices into personal banks, enabling transactions without a traditional bank account.

- Reduced Costs: By cutting out intermediaries, CBDCs can lower the cost of financial services, making them more affordable.

- Offline Capabilities: In areas with poor internet connectivity, offline CBDC transactions can still happen, ensuring everyone can participate.

Reducing Barriers to Financial Services

CBDCs are not just about reaching more people; they’re also about making financial services easier to use. Traditional banking can be complicated, with lots of paperwork and requirements. CBDCs simplify this by offering a straightforward digital platform.

- Simplified Processes: No more endless paperwork. With CBDCs, everything’s digital and streamlined.

- Instant Transactions: Forget waiting days for a transfer to go through. CBDCs can handle transactions in real-time.

- Lower Fees: Without the need for physical branches and staff, CBDCs can reduce transaction costs significantly.

Empowering Economic Participation

By making financial services more accessible and affordable, CBDCs empower more people to participate in the economy. This isn’t just about spending; it’s about saving, investing, and growing financially.

Imagine a world where everyone, regardless of their location or economic status, can save money securely, invest in their future, and contribute to the economy. That’s the vision CBDCs are working towards.

- Savings and Investments: With easy access to digital banking, more people can save and invest money, which is crucial for financial growth.

- Economic Growth: As more people participate in the economy, it grows stronger and more resilient.

- Increased Security: Digital transactions are often more secure than cash, reducing the risk of theft and fraud.

In conclusion, CBDCs are more than just digital money. They’re a tool for financial inclusion, breaking down barriers and opening up opportunities for everyone to engage in the financial system. As technology continues to advance, the role of CBDCs in bridging the financial gap will only become more significant.

Central Bank Digital Currencies (CBDCs) can help make banking easier for everyone. They can provide access to financial services for people who don’t have a bank account. This means more people can save money, make payments, and manage their finances better. If you want to learn more about how CBDCs can change the way we handle money, visit our website for more information!

Conclusion

Central Bank Digital Currencies (CBDCs) are shaping up to be a game-changer in the world of finance. As we look towards the UPSC 2025 Examination, it’s clear that these digital currencies are more than just a trend—they’re a glimpse into the future of money. With the potential to streamline transactions, enhance financial inclusion, and offer a secure alternative to cash, CBDCs are poised to revolutionize how we think about currency. However, like any new technology, they come with their own set of challenges, including privacy concerns and the need for robust regulatory frameworks. As countries like India explore the possibilities of CBDCs, it’s crucial to balance innovation with caution. The road ahead is exciting, but it requires careful navigation to ensure that the benefits of digital currencies are fully realized without compromising security or stability. As we prepare for the future, understanding and adapting to these changes will be key for both policymakers and the public.

Frequently Asked Questions

What is a Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency is like digital money issued by a country’s central bank. It’s just like the cash you use, but in digital form.

How does a CBDC differ from regular digital payments?

CBDCs are issued by the central bank and are legal tender, while regular digital payments are typically handled by private companies and are not legal tender.

Why are countries interested in CBDCs?

Countries are exploring CBDCs to make payments faster, safer, and cheaper. They also help in reaching people who don’t have access to traditional banking.

Are CBDCs safe to use?

Yes, CBDCs are designed with security in mind, using advanced technology to keep transactions safe and private.

How can CBDCs help people without bank accounts?

CBDCs can be accessed through digital wallets on phones, which means people don’t need a bank account to use them.

Will CBDCs replace cash?

It’s unlikely that CBDCs will completely replace cash, but they might be used alongside cash for more convenience.

What role does blockchain play in CBDCs?

Blockchain can be used to securely record transactions of CBDCs, but not all CBDCs use blockchain technology.

How can I learn more about CBDCs?

You can read articles, watch videos, or even join classes about digital currencies to understand more about how they work.