MCQs from CRASH Course

1. Which of the following statements is/are correct?

- Inflation can erode the value of the money owed by the debtor.

- Drop in consumer spending can lead to disinflation.

Select the correct code:

A. 1 Only

B. 2 Only

C. Both are Correct

D. None is Correct

2. Consider the following statements with respect to CPI for Industrial workers CPI(IW):

- It is released by National Statistical Organisation.

- The CPI-IW is based on the old series with the base year 1960.

- It is released monthly.

Which of the above statements is/are correct?

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 3 only

3. The provisions of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) is applicable to which of the following?

- Small Finance Banks

- Local Area Banks

- Regional Rural Banks

- Primary (Urban) Co-operative Banks

Select the correct code:

A. 1, 2 and 4 only

B. 1 and 3 only

C. 2, 3 and 4 only

D. 1, 2, 3 and 4

4. Which one of the following statements is incorrect?

A. Urban Cooperative Bnak can be placed under SAF when its Net NPAs exceed 6% of its net advances.

B. Co-operative banks can raise equity or unsecured debt capital from the public subject to prior RBI approval.

C. PACS are outside the purview of the Banking Regulation Act, 1949 and hence not regulated by the Reserve Bank of India.

D. None of the above.

5. Consider the following statements:

- Coal sector was nationalized by the Government of India under Indira Gandhi.

- Now, coal blocks are allocated on lottery basis

- Till recently, India imported coal to meet the shortages of domestic supply, but now India is self-sufficient in coal production.

Which of the statements given above is/are correct?

A. 1 only

B. 2 and 3 only

C. 3 only

D. 1, 2 and 3

Answers with Explanations

1. Which of the following statements is/are correct?

- Inflation can erode the value of the money owed by the debtor.

- Drop in consumer spending can lead to disinflation.

Select the correct code:

A. 1 Only

B. 2 Only

C. Both are Correct

D. None is Correct

Answer: C

Explanation

- A little inflation encourages you to buy sooner – and that boosts economic growth.

- Anyone with a mortgage or a loan benefits from inflation, as it has the effect of eroding debt.

- In a world of zero inflation some companies might be forced to cut wages.

- It keeps the interest rates positive.

- The government has a huge debt, which is getting bigger thanks to a deficit. It would love to see that eroded by inflation, which in turn would see its own income rise.

- As long as there’s a good dose of inflation in the system, tax revenue should go up, even if the economy is stagnant.

2. Consider the following statements with respect to CPI for Industrial workers CPI(IW):

- It is released by National Statistical Organisation.

- The CPI-IW is based on the old series with the base year 1960.

- It is released monthly.

Which of the above statements is/are correct?

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 3 only

Answer: D

Explanation

Various CPIs compiled in India are:

- CPI for Industrial workers CPI(IW)

- CPI for Agricultural Labourers CPI(AL) & CPI Rural Labourers CPI (RL)

- CPI (Urban)

- CPI (Rural)

Labour Bureau (Occupation specific & Place Specific):

- CPI (IW) + CPI (AL & RL)

National Statistical Organisation

- CPI(Urban) and CPI(Rural)

3. The provisions of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) is applicable to which of the following?

- Small Finance Banks

- Local Area Banks

- Regional Rural Banks

- Primary (Urban) Co-operative Banks

Select the correct code:

A. 1, 2 and 4 only

B. 1 and 3 only

C. 2, 3 and 4 only

D. 1, 2, 3 and 4

Answer: D

Explanation

The provisions of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) shall apply to all

- Scheduled Commercial Banks (SCBs) (including Regional Rural Banks)

- Small Finance Banks (SFBs)

- Payments Banks

- Local Area Banks (LABs)

- Primary (Urban) Co-operative Banks (UCBs)

- State Co-operative Banks (StCBs) and

- District Central Co-operative Banks (DCCBs) unless stated to the contrary.

4. Which one of the following statements is incorrect?

A. Urban Cooperative Bnak can be placed under SAF when its Net NPAs exceed 6% of its net advances.

B. Co-operative banks can raise equity or unsecured debt capital from the public subject to prior RBI approval.

C. PACS are outside the purview of the Banking Regulation Act, 1949 and hence not regulated by the Reserve Bank of India.

D. None of the above.

Answer: D

Explanation

Cooperative Banks Regulation

The amended Act applies some of these provisions to them, making their regulation under the Act similar to that of commercial banks:

- The Act seeks to extend RBI regulation of co-operative banks with respect to management, capital, audit and winding up.

- Co-operative banks may raise equity or unsecured debt capital from the public subject to prior RBI approval.

- RBI may prescribe conditions on and qualifications for employment of Chairman of co-operative banks.

- RBI may remove a Chairman not meeting ‘fit and proper’ criteria and appoint a suitable person. It may issue directions to reconstitute the Board of Directors in order to ensure sufficient number of qualified members.

- RBI may supersede the Board of Directors of a co-operative bank after consultation with the state government.

- The act allows RBI to undertake reconstruction or amalgamation of a bank without imposing a moratorium.

SUPERVISORY ACTION FRAMEWORK FOR PRIMARY (URBAN) CO-OPERATIVE BANKS (UCBS)

- Reserve Bank monitors asset quality, profitability and capital/net worth of UCBs for deciding the severity of stress in them and whether they need to be put under the SAF.

- Asset quality:

-

- A UCB may be placed under SAF when its Net NPAs exceed 6% of its net advances.

- Profitability:

-

- A UCB may be placed under SAF when it incurs losses for two consecutive financial years or has accumulated losses on its balance sheet.

- Capital to Risk-weighted Asset’s ratio (CRAR):

-

- A UCB may be placed under SAF when its CRAR falls below 9%.

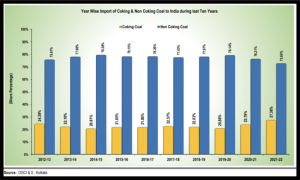

5. Consider the following statements:

- Coal sector was nationalized by the Government of India under Indira Gandhi.

- Now, coal blocks are allocated on lottery basis

- Till recently, India imported coal to meet the shortages of domestic supply, but now India is self-sufficient in coal production.

Which of the statements given above is/are correct?

A. 1 only

B. 2 and 3 only

C. 3 only

D. 1, 2 and 3

Answer: A

Explanation

➡️UPSC 2023 General Studies Course: https://sleepyclasses.com/general-studies-for-upsc/

➡️Sociology Optional for UPSC : https://sleepyclasses.com/sociology-for-upsc/

➡️Political Science and IR for UPSC: https://sleepyclasses.com/psir-for-upsc/

➡️Signup here – https://sleepyclasses.com/

Have any query related to UPSC preparation: 📞Contact Us ► Toll-Free: 1800 890 3043 ► Mobile: 6280133177 ► Email: Sleepy.Classes@gmail.com ► WhatsApp: 6280133177